You know when you look at your closet and think “Wow I have nothing to wear” even though you had bought a few things a couple weeks prior?

Do you ever feel that way about your finances? You look at your account and think “Wow I am broke” even though you feel like all you did was work.

Well, you’re not alone.

I’ve met many incredibly hardworking and smart people who have impressive jobs but have no idea where their money went. Sometimes it really feels like money escapes us.

And it’s true. Without a clear strategy, money controls us. If we are not the ones telling our hard-earned paychecks where to go, we will get lost and find ourselves confused about how we ended up here.

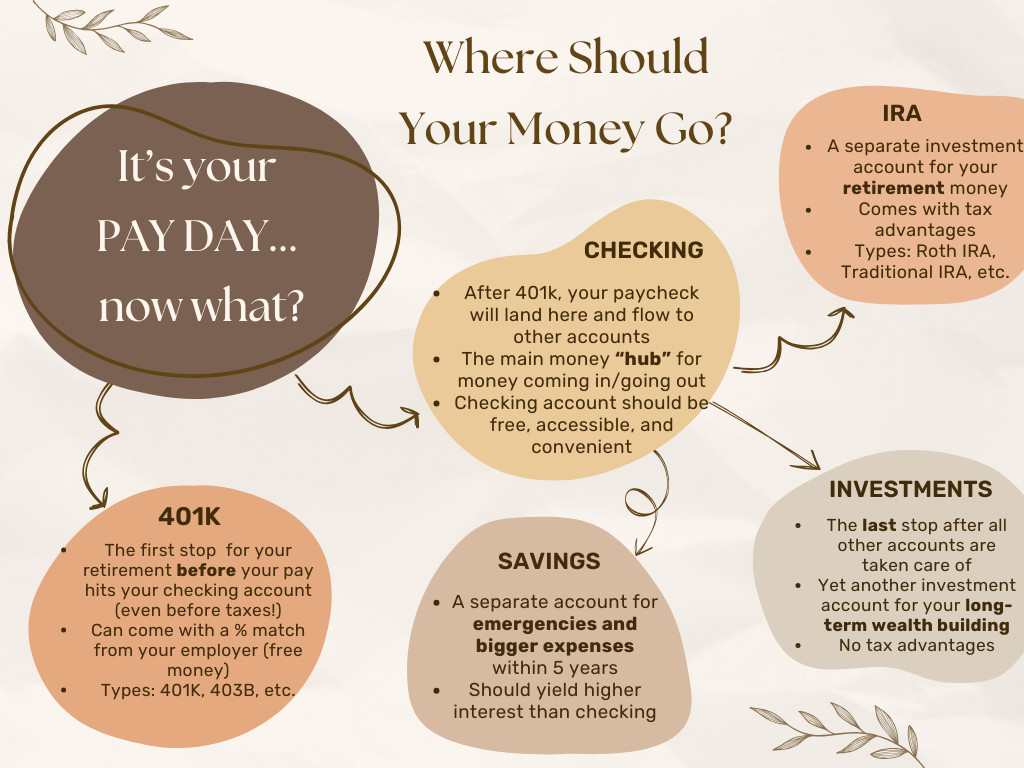

Managing your finances starts with knowing where your money is going. And building a successful financial strategy starts with creating a roadmap of which accounts your money should go to.

So where should your paycheck go?

If I were to ask you to draw me a roadmap or a direction for where your paycheck should go, what would it look like?

If you have difficulty with the above, don’t worry. That’s what this post is for!

I’m here to tell you exactly where your paycheck should go. There are five money accounts I consider essential for your financial wellness, and understanding these accounts will be a great start if you’re just getting started.

1) 401K

401k is a retirement account your employer provides. If you choose to enroll, you contribute a percentage of your salary which may also get matched by your employer up to a certain percentage, which means you’re getting free money!

401k is the most common, but there are also 403(b) plans for non-profits and schools and 457s for government employees. If you enroll in a 401k, your contributions will be deducted from your paycheck before taxes. This will reduce the amount of your income that can be taxed aka you will pay less taxes while you put money aside for retirement. After your contributions, your pay gets taxed then it will finally land in your hand.

401k is also an investment account, so the money you put in can grow over time. However, the money will just sit there if you don’t select your investment. DO NOT forget to invest your 401k money. If the word ‘investing’ is daunting, just select a target date fund and let your money grow. A target date fund will automatically shift the investment mix based on your planned retirement year so it will be low-maintenance.

2) Checking Account

After 401k (if you are enrolled), your paycheck will land in your checking account. This is the central hub for your everyday transactions like daily expenses and bills. So any money you need for your everyday needs (like rent) should be kept in a checking account. It also comes with a debit card which allows you to access your money when you need cash from a bank or an ATM. For this reason, your checking account should be accessible and convenient.

If you have a credit card, it will be connected to your checking account as well. Don’t forget that your credit card bills count as regular expenses you should be able to pay off every month. So make sure to keep enough money in your checking account to cover such expenses.

3) IRA (Individual Retirement Account)

An IRA is a retirement account that is separate from your employer. It is also an investment account, so the money can hopefully supplement your 401k income for retirement. There are different types of IRAs, but a Traditional IRA and a Roth IRA are the most common.

Traditional IRAs are similar to 401ks in that you can make pre-tax contributions with them, which would bring your taxable income down. However, when you withdraw money for retirement, you will get taxed.

On the other hand, Roth IRA contributions are made with after-tax dollars, but when you withdraw money during retirement, you won’t be taxed. This can potentially mean over $1 million tax-free! When people talk about a Roth IRA being one of the best investment vehicles, this is why.

4) Savings

Some people confuse savings with checking accounts, but saving accounts are for storing money for future expenses. This is where the cash you may need in the next few months or years should be kept. Some examples include your emergency fund for a rainy day, a future car deposit, or a down payment for your future home.

Your savings should still be accessible and overall very low-risk. However, a savings account should still give you a higher interest than your checking account. Also, keep in mind that savings accounts are best for short-term goals (my rule of thumb is ~5 years). If you have no plans to buy a home until 20 years later, that money is better kept in an investment account.

If you don’t have your emergency fund yet or are working towards a savings goal, check out my tips here on boosting your savings!

5) Investment Brokerage Account

An investment brokerage account is where you can buy or sell different investment options like stocks, bonds, index funds, mutual funds, etc. Note that your 401k and Roth IRA are also investment accounts. However, the difference is that an individual investment account is subject to capital tax gains and no withdrawal restrictions.

Although an investment account is great for building long-term wealth, this should be the last account you open. You should prioritize your checking, savings, and retirement accounts for your daily transactions, rainy day expenses, and future income for retirement.

Summary

So now you have the five money accounts you need for a balanced financial life!

Remember that a checking account is for your daily expenses while a savings account is for emergencies and future expenses (~5 years). You should prioritize your retirement accounts like your 401k and a Roth IRA for their tax advantages. And lastly, when you feel good about the first four, you should absolutely open an investment account.

As you can see, each account comes with its pros and cons. Each has a different role in your wealth-building portfolio, and you should maximize each to its full potential.

There is way more to learn about each, but I hope this gives you a good start on when and where your paycheck should go.

Comments

6 responses to “What to Do with Your Paycheck to Master Your Finances”

Going to open up my Roth IRA right now! Where did you open up yours?

Hi JP! I have my Roth with Fidelity- highly recommend

Amazing post! Its so simple yet thoroughly explained! Thanks

Thanks for the visit and the kind words!!

Wow this is a great resource. Can’t wait to share this with other people

Glad it was helpful, thanks so much Erin!