In 2020- during the peak pandemic time- I was making sales commission checks and had no restaurants and vacation plans to spend them on. This was the opportune time to finally up my investment game by opening a Roth IRA.

I had heard about the Roth IRA, and it became a New Year’s goal of mine to open one in 2021.

So right before January 1st, I finally opened my Roth IRA with Fidelity.

You can say I felt like an ~investor~

Except I wasn’t. Yet.

Opening an account vs Investing

I had opened an account but had not invested anything. This is where I see many people get confused, not just with a Roth IRA, but with any investment account.

Just because you opened an investment account and put $500 into it does not mean that the money is invested.

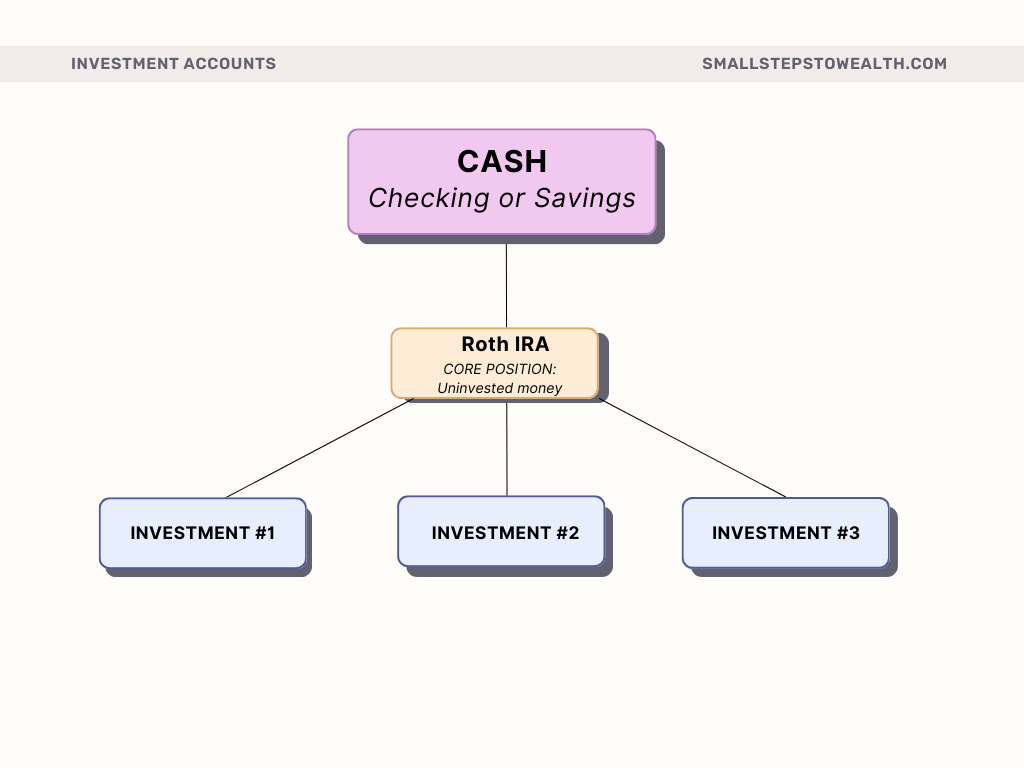

Check out this simple graph:

When you open a Roth IRA or any other investment account, you simply have an account. When you link your bank account and transfer the money into your Roth IRA, you create that link between the pink box and the yellow box.

Once your money is transferred, you’re at the yellow box. Your money is uninvested.

It’s only when you buy assets (stocks, mutual funds, ETFs, bonds, etc.) within the account that you can say you’ve invested.

When I first opened my Roth IRA, I knew I had to invest the money I transferred, but I had no idea how.

None of the buttons and interfaces made sense, and there were so many buttons. It’s not super intuitive for new investors.

And I think this is a big reason people shy away from investing. Maybe the thought of even opening an account is daunting. Or they have an account but have no idea what to do with it.

How to open a Roth IRA

Sure, we hear the word “invest” a lot, but have you ever wondered “So how do people go about investing?”

With tangible assets like houses, you are likely working with a broker in person (plus a bunch of paperwork).

With non-tangible assets like company stocks, you also need a broker, but you don’t have to call them up. We can sign up with a brokerage firm online!

So the very first thing you need to do before investing in a Roth IRA is to choose a brokerage firm, which is simply a financial firm you can open an account with. It gives you the platform (access) to various investments like how a real estate broker would show you an inventory of available homes.

I use Fidelity as my main brokerage firm, and it’s what I’ll use in my guide. There are plenty of other options though- like Vanguard, Charles Schwab, eTrade, etc.

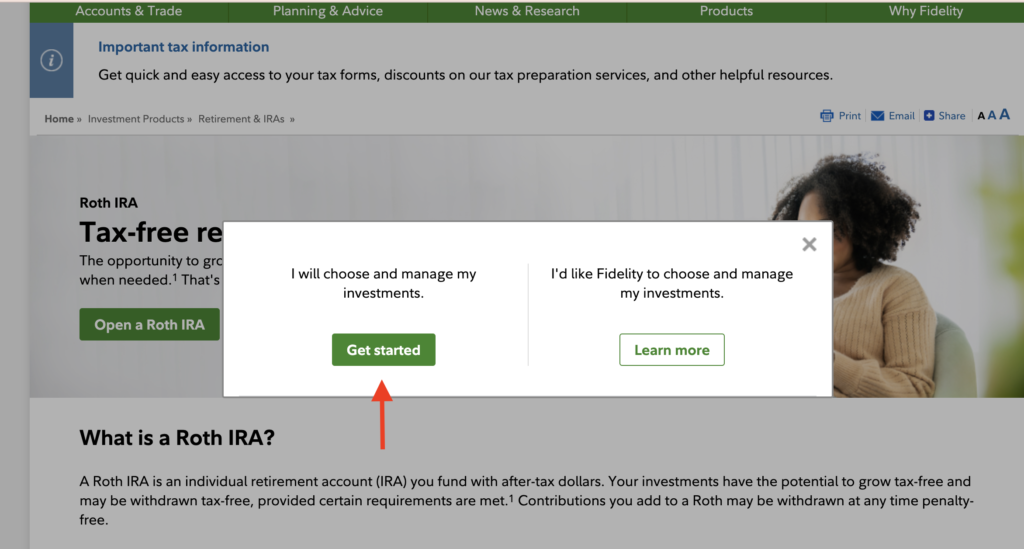

With many brokerages, you will have two options: 1) One to choose and manage your investments, and 2) One to have the firm choose and manage your investments for you.

This guide focuses on the first option– choosing your own investments- because I believe it’s totally doable for even novice investors! The second option is also great for those with minimal time, but it comes with a % fee. So make sure you triple-check that!

Step-by-Step Guide

The best way to follow this guide is to follow along in another window.

OK, let’s jump in.

1) Go to the Roth IRA page of Fidelity and click on the green button that says “Open a Roth IRA”:

Click the linked page in the instructions and start your application.

2) Select the “Get Started” button under I will choose and manage my investments:

3) Select ‘No’ for Are you a Fidelity Customer?

If you are completely new to Fidelity, select ‘No.’

If you already have a Fidelity account, click “Yes” and it will have you sign into your account. Your application will already be auto-populated with your existing account information, so you can bypass a lot of the next steps.

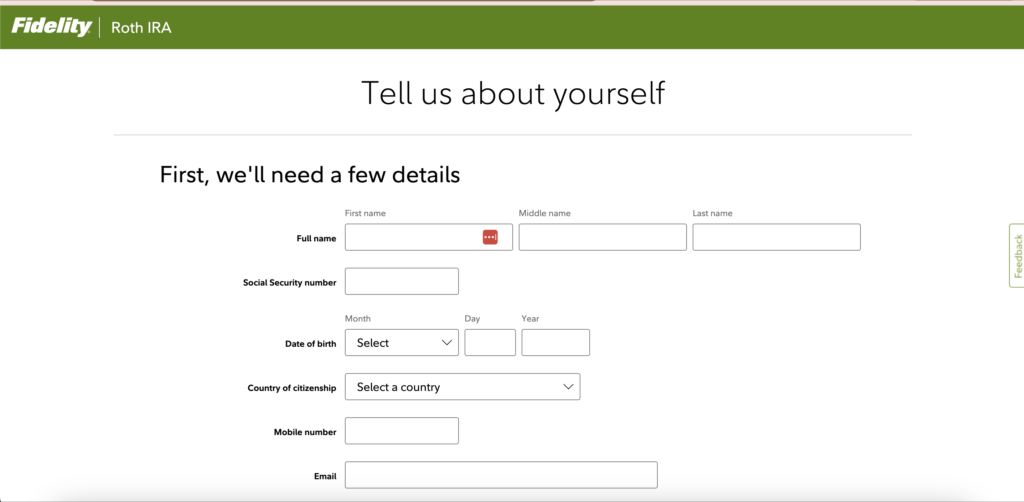

4) Fill out the application- personal info, social security number, contact info, employment:

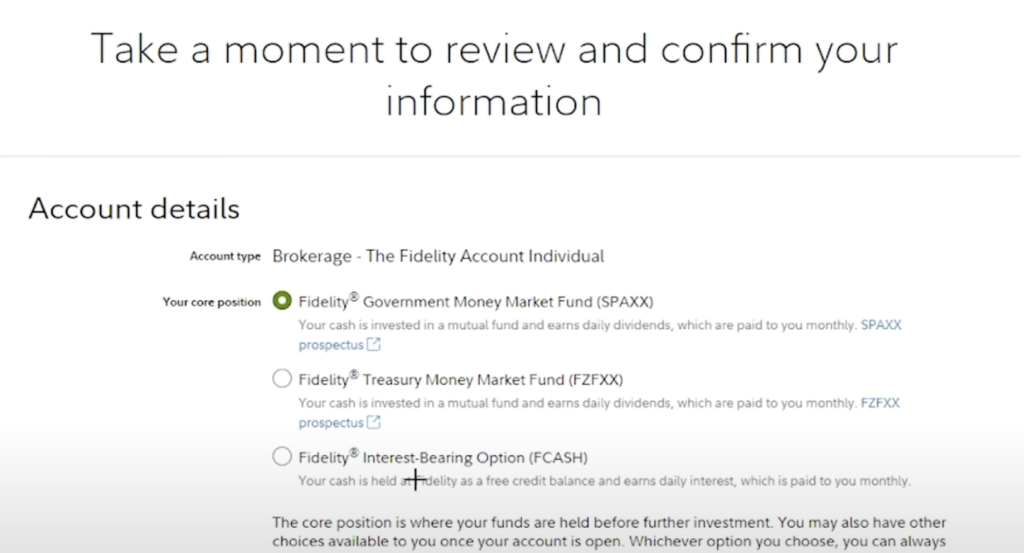

5) Select your account’s core position. If uncertain, leave it at the default option:

Your account’s core position is where your money will be if it isn’t invested.

Remember the chart above that showed different colored boxes? This is choosing which account your money will automatically flow into when you transfer it from your checking or savings.

Obviously, once you invest the money, it will leave the account’s core position.

In the picture below, each option has a short description. The first option in the picture is typically the safest- it’ll hold your cash while earning you a small amount of money back.

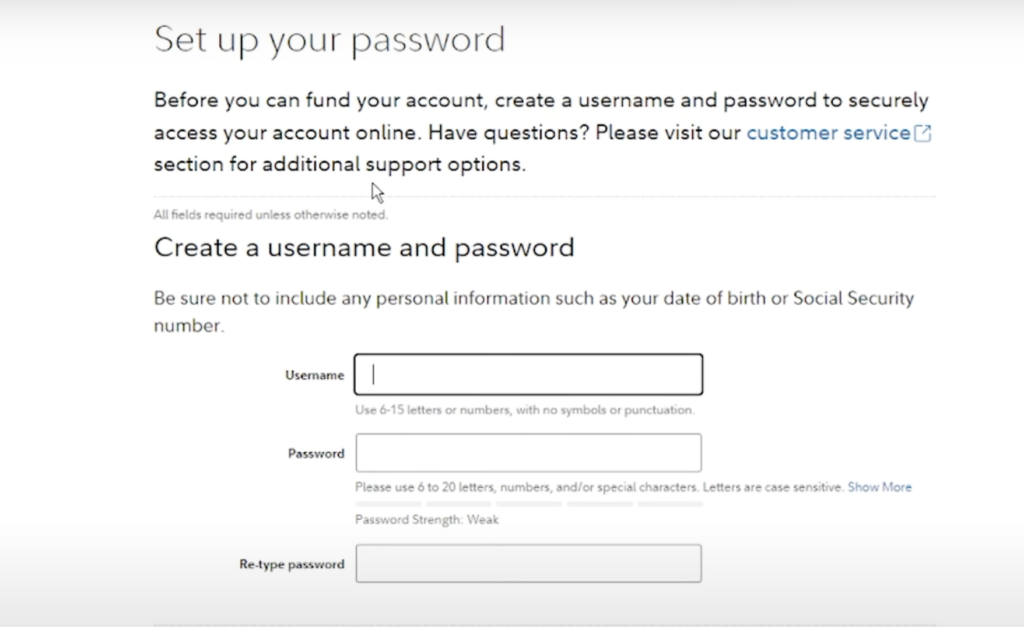

6) Review the agreements and set up your online account!

Once you proceed with the application, it will automatically take you to a page to set up your account.

Voi-la! You just opened your Roth IRA account!

But remember, you’re not done yet! You have opened the account but have not invested anything yet. Keep reading.

How to link your bank account and transfer money

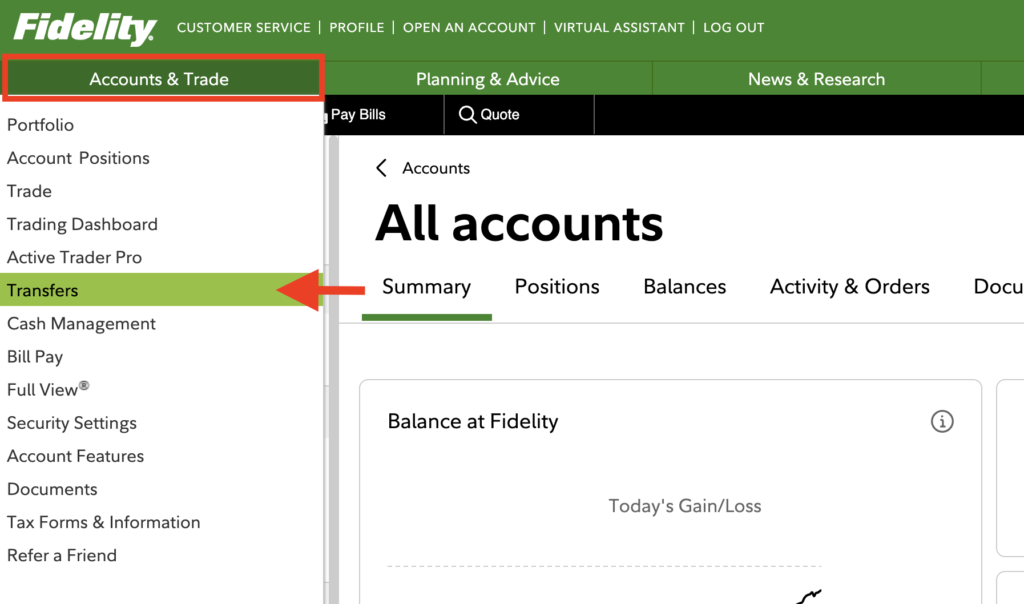

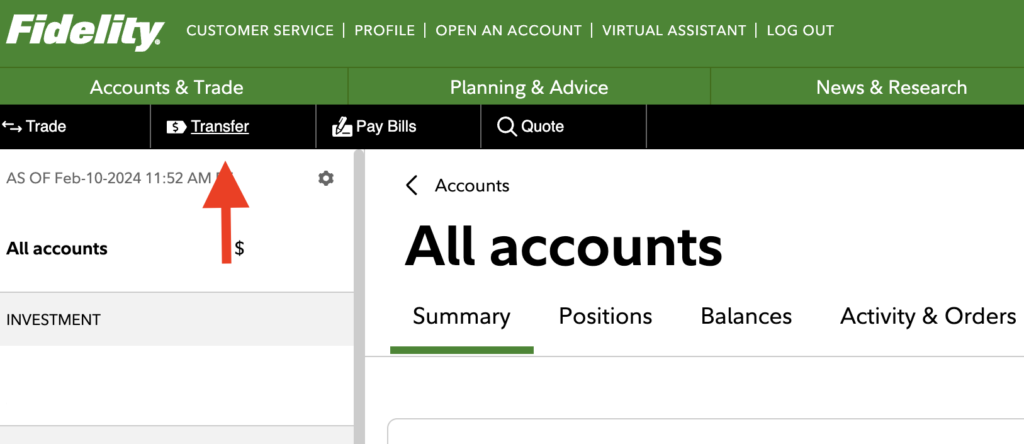

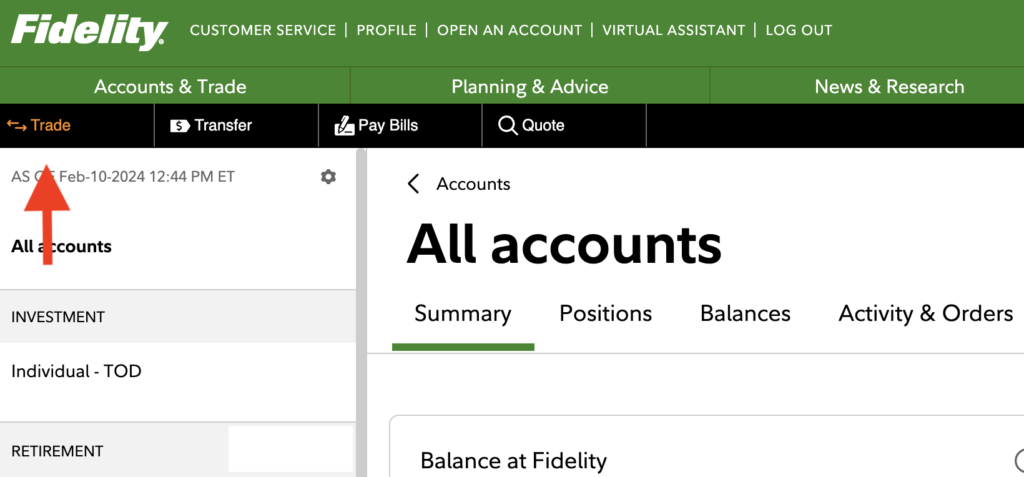

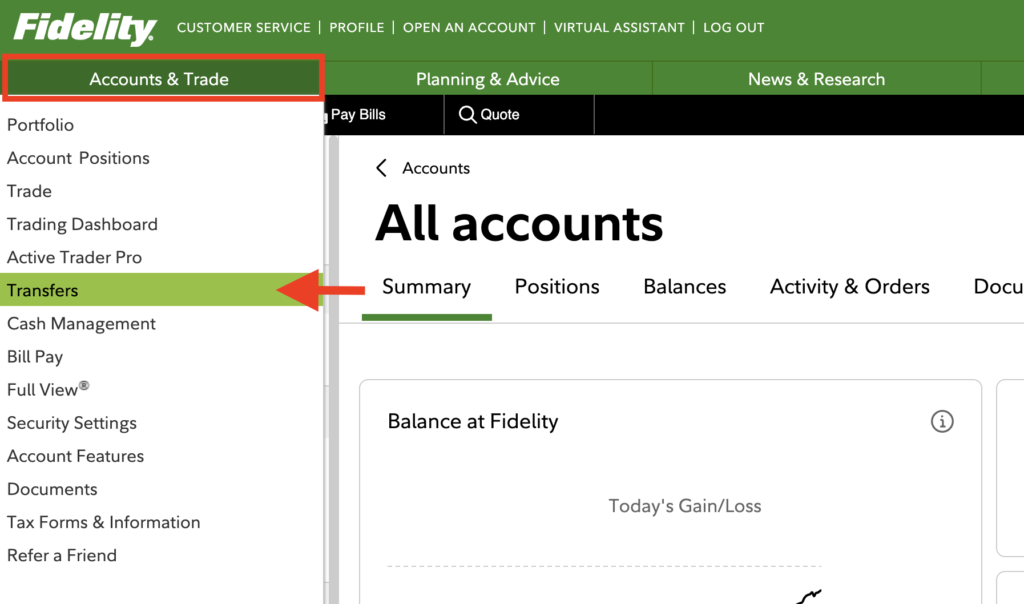

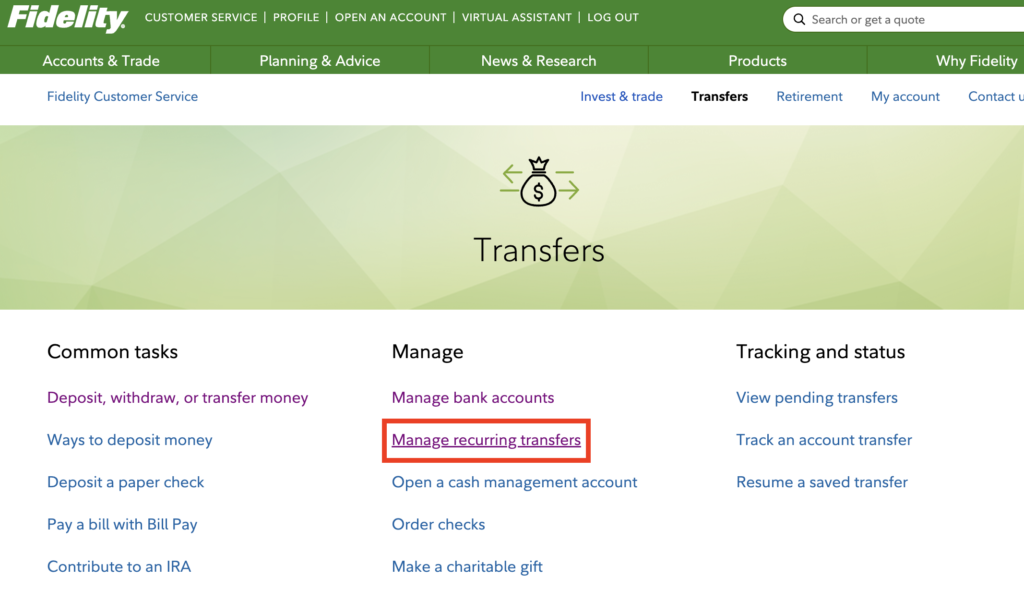

1) Navigate to the “Accounts & Trade” button at the top left and click “Transfers”:

Now that you’ve opened the account, let’s link your bank account so you can start funding it.

Don’t forget- you’ll need some money in the account to invest it.

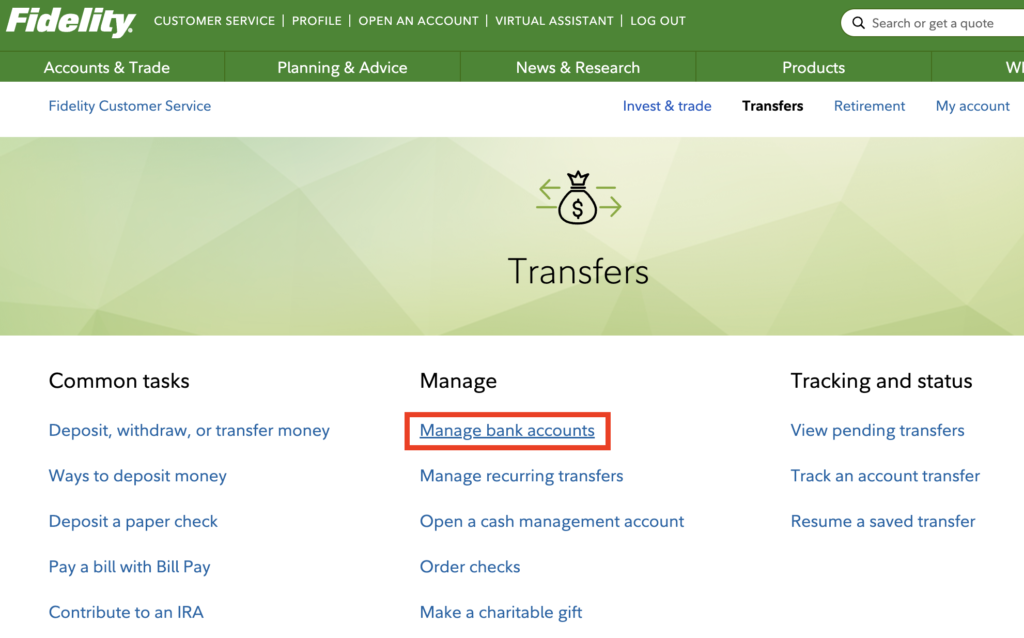

2) Click “Manage bank accounts” then “Link a new bank account”:

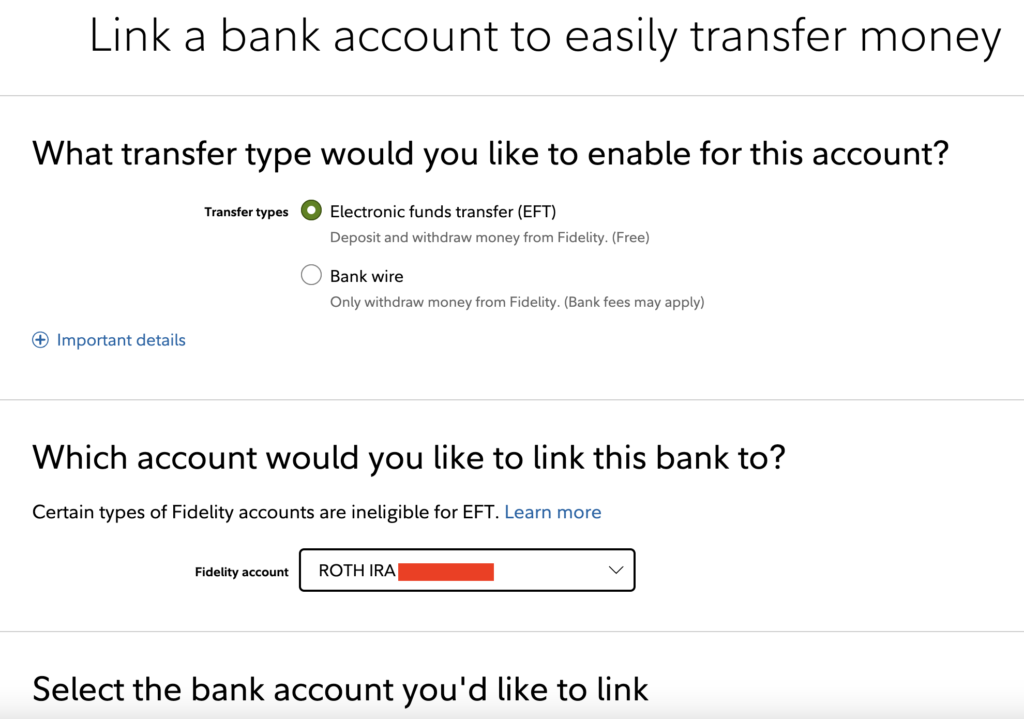

3) Choose the EFT (Electronic Fund Transfer) option then click Next:

This will be the default/ free option, so select this and choose the Roth IRA account you just opened for the next question.

4) Fill out your bank information- routing number and account number:

If you have multiple checking and/or savings accounts, choose the one that is the most accessible, easy to use, and well-funded.

You don’t want to choose a random checking account you haven’t touched in a while with a $3.05 balance. If you are going to link a checking account, I recommend the one that receives all or the majority of your paycheck.

If you want to link your savings account to your Roth IRA, make sure it’s separate from your emergency fund. You do not want your emergency savings to fund your retirement account.

Once you decide which account to link, you may need to log into your bank account online, look at your check, or look for the notepad you wrote this information. After you find the Routing # and Account # of the account you wish to connect it to

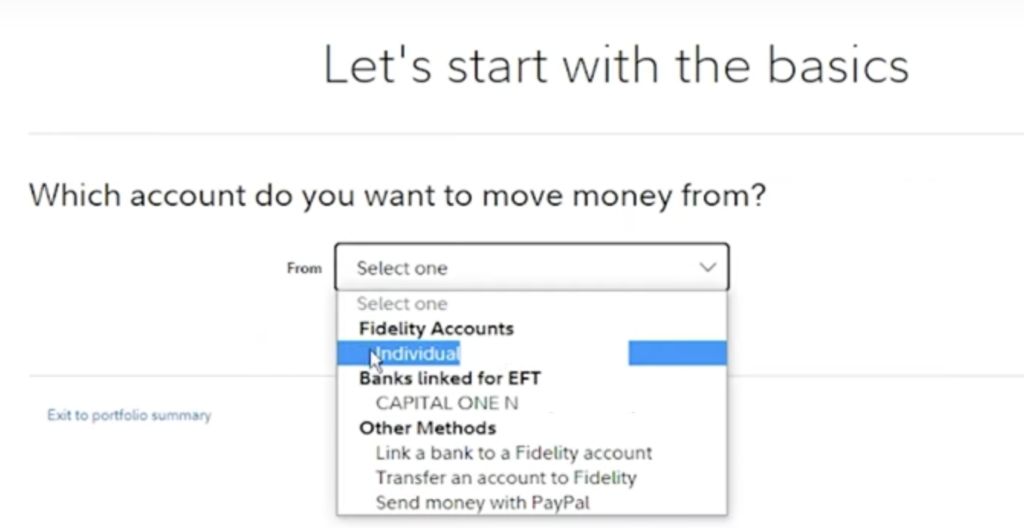

5) After linking your bank information, go back to the Home page and click “Transfers”:

6) Select the bank account that you just linked:

The bank account (savings or checking) is where your money will be taken from. The amount you select will then go into your Roth IRA so you can start investing.

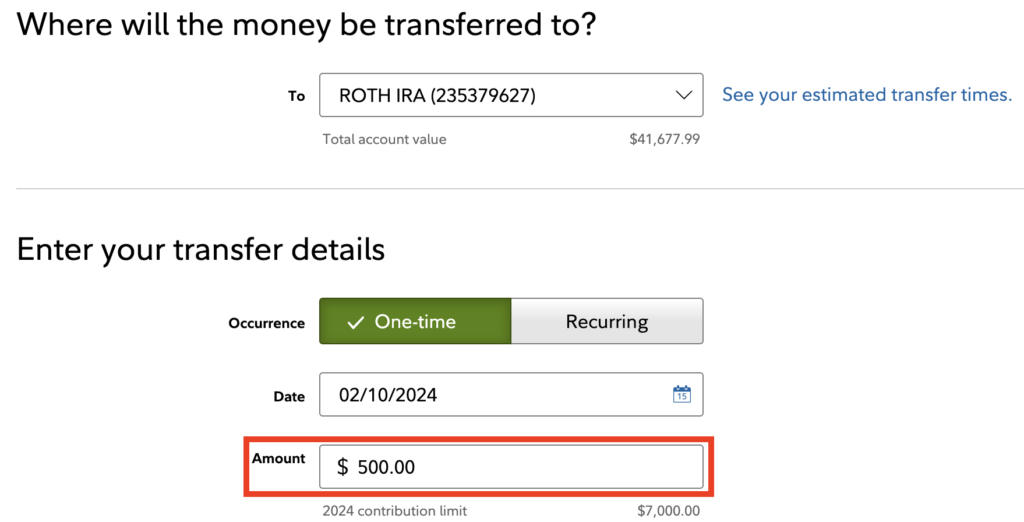

7) Write in the amount you want to transfer from your linked bank account to your Roth IRA:

Note that it can take up to 2~4 business days for your money to transfer.

What this means: If you set a $500 transfer, forget about it, and your bank balance goes below this amount before the transfer is complete, your account will be in the negative.

So start with an amount you’re comfortable with and choose a date when your bills aren’t due. I’ll go into more detail in the next step.

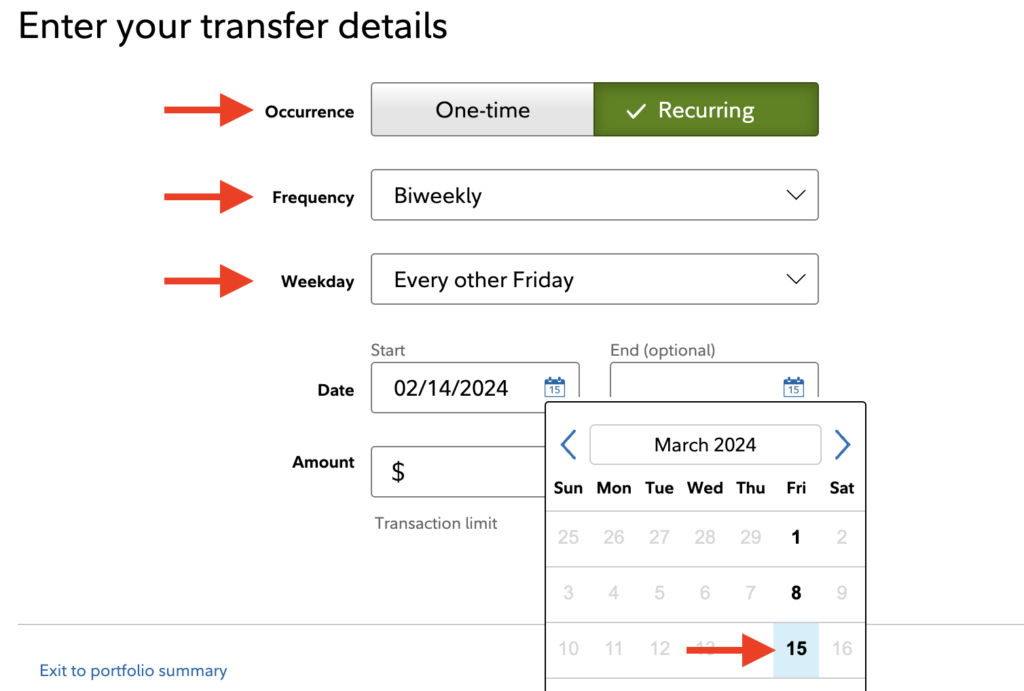

8) (Optional) Set up a recurring transfer, so you don’t have to think about it:

Another option you can consider (and I recommend) is setting up a recurring transfer. This minimizes manual work and helps set an investing routine.

Instead of the default “One-time” option, select the “Recurring” option for your transfer occurrence.

Then choose the frequency you’re comfortable with. In this example, I selected Biweekly because I can easily match it to my biweekly paychecks.

If you want to start with smaller amounts more frequently, you can also choose Weekly. For example, you can start by transferring $50 a week if the thought of investing seems intimidating.

In the scenario above, I am choosing to transfer money on a biweekly basis around my paycheck date, March 15th.

As I’ve noted earlier, the transfer will take a couple of business days, so the money will likely leave my bank account around Tuesday or Wednesday of the following week.

That’s when the money will become available for investing in my Roth IRA.

How to invest in a Roth IRA

OK now you are all SET UP!

But wait, you’re still not done yet. It’s finally time for you to start investing!

This may look intimidating at first, but trust me, it is so simple once you try it out.

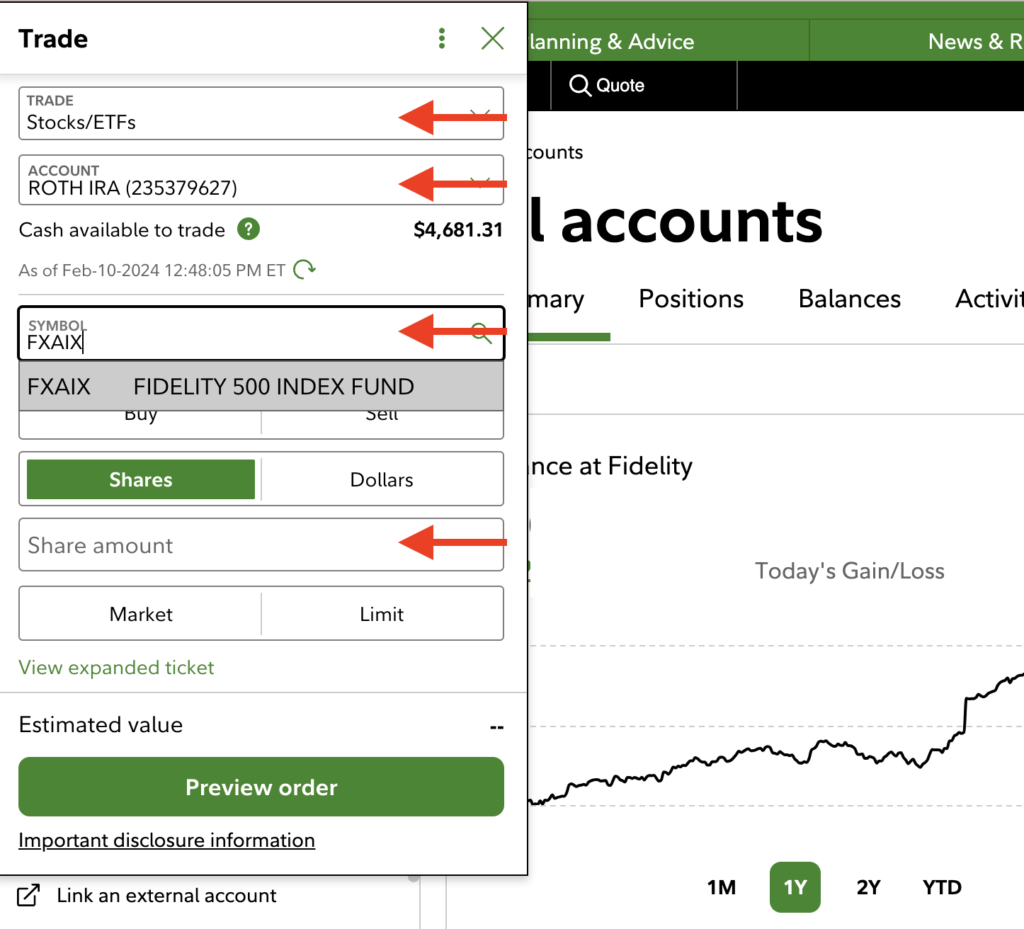

1) Click on the “Trade” button under Accounts & Trade:

2) In the small pop-up window, select the Account you want to invest in (Roth IRA) and what you want to trade:

So once you click the “Trade” button, a small pop-up window will open in the top left.

The Trade box at the very top is the type of assets you can buy/ sell. It is set to “Stocks/ETFs” by default.

In many cases, you can start typing in the ticker symbol of the asset you want to trade in the Symbol field. A ticket symbol is simply the abbreviated nickname of a stock or a fund.

In this example, I started typing “FXAIX” and the search option popped up.

The Trade type at the top will automatically change to match the asset you’re buying so don’t worry too much about it as long as you have the ticker symbol.

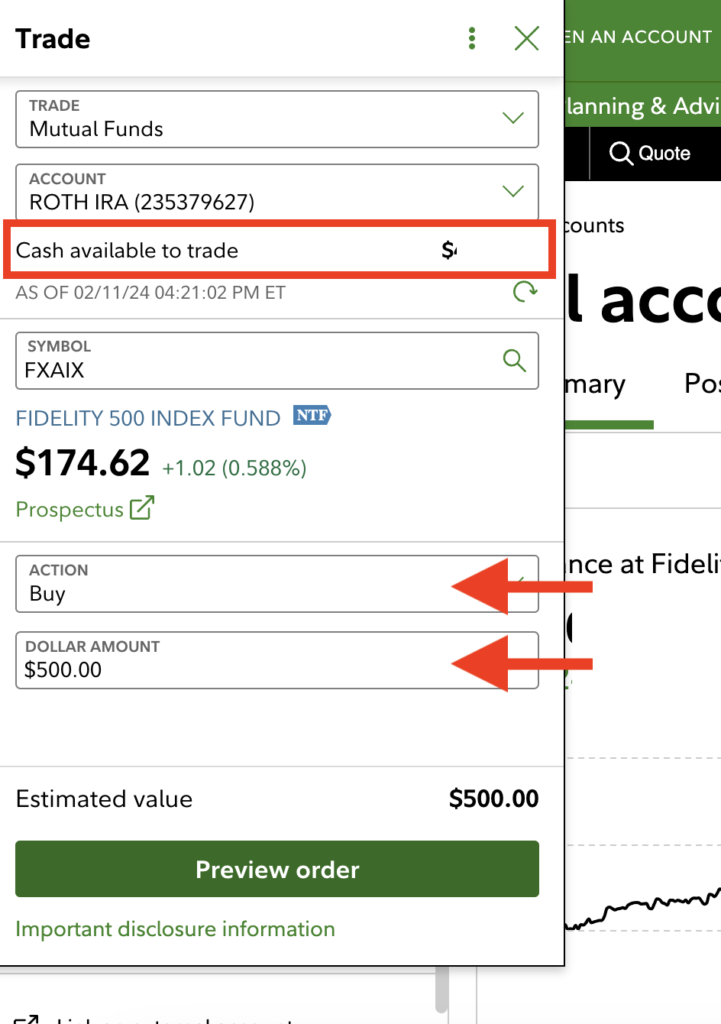

3) Select “Buy” for the Action and fill in the dollar amount you want to invest:

When you open a Roth IRA for the first time, you will not have any investments to sell.

So the first several trades (and hopefully for a while) you make would be to buy investments.

Once you’ve selected what you want to buy, you have to select the action “Buy” and fill in the exact amount you want to purchase.

The red box at the top will show you how much you have in your Roth IRA available for trading (mine is blurred out, but you get the idea). If you only see $200 available for trading, you obviously can only spend up to how much you have.

Depending on what you are buying/ selling, you may see an option to buy in shares. A share is basically a unit of ownership (how much of the company or the fund you owe). I almost always buy in dollars instead because it’s simpler.

4) Review and “Place order”:

YAY! You did it!

Review the details of the order and click “Place order” to complete the transaction.

Just note that some may not go through if not done during business hours, so don’t be discouraged if this happens.

5) (Optional) Set up automatic investments:

So you love the idea of automating and making it easier for yourself?

So do I.

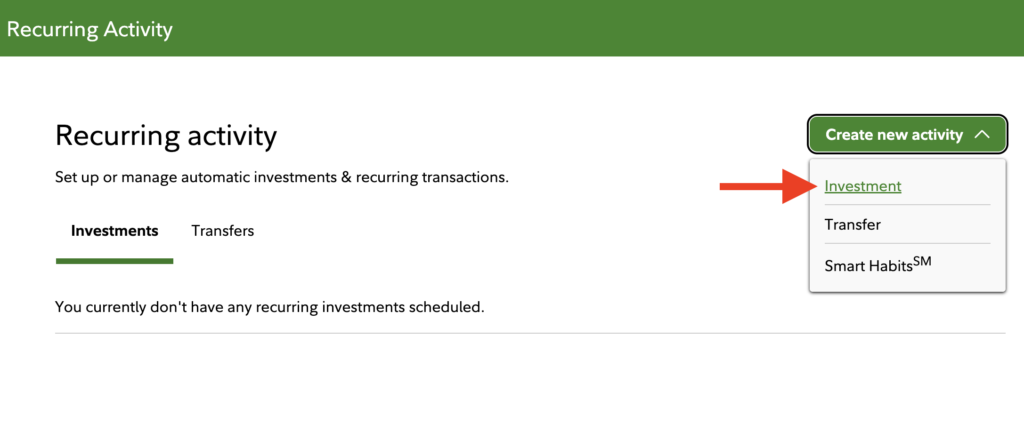

This part is a little annoying because the option to set up recurring investments is not super visible. But once you set it up, this will set your investing life on auto-pilot mode.

To do this, you have to go back to the “Transfers” button from your home page (portfolio) view.

It will take you to this page where you can select “Manage scheduled transfers.”

Go to the top right and click “Create new activity” to choose “Investment.”

An almost identical pop-up window to the previous trading window will appear.

Follow steps 2~4 to set up automatic investments.

You may have to be a bit exact with the “Trade” you select this time, but you can simply Google this to find out.

Invest away!

You did it!

If you’ve come this far and have opened a Roth IRA, congratulations! This is a huge step for the future you, so you should be proud.

Now that your account is all set up, you can invest away. And don’t fret, it doesn’t have to be hard.

If you’re totally lost on what to invest in, you can consider putting all your money into a target fund. An example of this would be the FFIJX (Fidelity Freedom Index 2065 Fund).

A target date fund is made up of different investments and is automatically adjusted based on your target retirement age.

So the FFIJX- the Fidelity Freedom Index 2065 Fund- will automatically shift the investment mix based on the assumption that you will retire in 41 years.

This is the most low-maintenance yet still an effective way to approach your investments.

Each person’s risk tolerance and preference is different, so there’s no one-size-fits-all all approach. But I hope this serves as a helpful guide to get you started.

Have fun and invest away!