The difference between a Roth IRA vs Savings is simple- one is a retirement account and the other is not. And one is an investment account, and the other is not.

So a savings account is pretty simple. It’s an account you open with a bank for future expenses. It’s basically having a bank hold onto your money until you have to use it.

Your future expenses could be any emergencies or future goals like a wedding, a house, vacations, etc.

Usually, savings accounts will reward you some money for entrusting your money with them. This is the interest they give you.

But typical savings accounts at many brick-and-mortar banks will give a negligible amount of money in interest. This is why it’s so important to leave your savings in a high-yield savings account (HYSA) which can give you 4~5% more in interest.

What is a Roth IRA?

So a savings account is simply an account that holds your cash and you may get a little bit of money back from the bank for it.

On the other hand, a Roth IRA is a retirement account with the purpose of growing your money for your retirement years through investing.

You can’t open this with a normal bank- you need a brokerage firm to open a Roth IRA (or any retirement account).

And unlike checking or savings accounts where you leave your cash, a Roth IRA is an investment account that gives you access to various assets you can buy and sell.

Once you transfer your cash into a Roth IRA, you invest it so that the money doesn’t just sit there and lose value to inflation.

But that is not the end! What makes a Roth IRA special is its tax advantage.

Every retirement account comes with some sort of tax advantage, and a Roth IRA allows you to withdraw your money at retirement tax-free.

You will have to contribute to it with your take-home pay (after you pay taxes), but when you withdraw the money at age 65, you will pay $0.

This is a great benefit for many of us who will likely make less money at 22 than when we’re near retirement age and likely in higher income brackets.

So to summarize the characteristics of a Roth IRA:

– It’s a retirement account

– It’s an investment account

– You contribute to it with post-tax money

– You can withdraw your contributions without penalty (but not recommended)

– You withdraw from it after retirement age, tax-free!

How much your money will be in Savings vs a Roth IRA

As you can see, a savings account and a Roth IRA serve different purposes.

One is for sort of foreseeable future expenses- within the next few years- whereas the other (Roth IRA) is for way down the line for when you’re retired.

So assuming that you are at least 10+ years out from retirement, let’s see where you should keep your money.

How much of a difference can investing in a Roth IRA actually make?

Let’s see for ourselves. Sometimes raw numbers hit us differently than graphs:

In the chart above, you see how much you would have if you opened a savings account vs a Roth IRA with $5k and contributed $300 every month.

With a savings account with a 1% interest, you would have $23,702 in 5 years. Not bad.

After 40 years, you would have $184,240.

Let’s see how this compares if you did the same thing but invested in a Roth IRA. This is assuming a 7% return annually on your investments (it’s pretty close to the historical average).

Even within the first 5 years, you see that your Roth IRA is giving you higher returns.

And after 40 years, you would have $604,420 more by simply investing in your Roth IRA instead of leaving the cash in your savings.

And this isn’t even the whole picture. If you maximize your Roth IRA contributions every year starting in your 20s or early 30s, you will have around or more than $1 million by retirement age.

Can anyone contribute to a Roth IRA?

As long as you have earned income and make it under a certain income limit, you’re good to open a Roth IRA.

The table below from Investopedia clearly outlines the 2024 income eligibility for single and married people.

Source: Investopedia

It’s important to know though that the income requirements are based on the modified adjusted gross income (MAGI) which could be different from your total income.

For example, your retirement contributions (aka 401k) can reduce your adjusted gross income and help you get in the eligible range. So even if your gross income is above the limit, do not automatically count yourself out!

However, determining your MAGI is complex, so don’t even try doing it manually.

Rather than doing the math yourself, you can find your GI on line 7b of IRS Form 1040 (your annual tax return). Your GI will be the basis for your adjusted gross income (AGI) calculation.

If your income is still too high, you can consider the Backdoor Roth IRA which is essentially contributing to a Traditional IRA then converting it right away to a Roth IRA. It does come with tax implications and is fairly complex though, so we’ll gloss over it for now.

Roth IRA vs Other Retirement Accounts

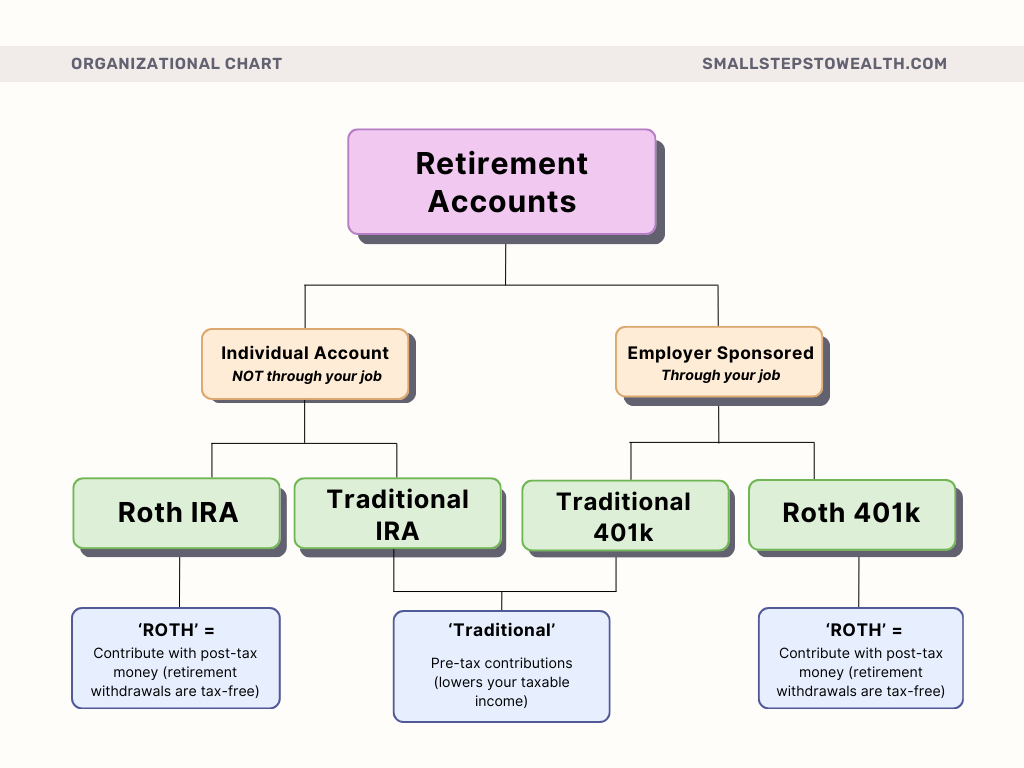

There are many retirement accounts that all sound very similar- Roth 401K, traditional IRA, traditional 401K- and it’s easy to confuse them!

My first job provided a Roth 401k and I remember being very confused.

But there are important differences to remember that will impact your finances. Plus, it’s pretty simple to distinguish them.

This chart provides a simple overview of the different retirement account types:

Here are the key points:

– Accounts with an “IRA” or a “401k” are retirement accounts

– Retirement accounts come with tax advantages- for either now or for later when you’re retired

– Retirement accounts are investment accounts

– If there’s a “401k” in the name, it’s employer-sponsored (aka from your job)

– If it has an “IRA” in the name, it’s a separate account not tied to your job

– If there’s a “Traditional” in the name, contributions are pre-tax

– If there’s a “Roth” in the name, contributions are post-tax, but retirement withdrawals are tax-free

Summary

If you couldn’t tell, I love a Roth IRA.

Once you get started with it, it becomes a key component of retirement planning.

I think it’s supreme to many other investment vehicles because it lets you pay $0 in taxes when you’re retired.

But I get that everyone has different circumstances, and sometimes, a Roth IRA may not be right for you. In that case, I hope the overview of the other retirement accounts helped in simplifying some similarities and differences.

And if you haven’t opened any retirement account for the future you, did this help convince you at all?

I hope it did!