Welcome to the kickoff of my new series, Common Money Questions! Here, I’ll dish out quick and easy answers to those burning money questions we all have.

Let’s dive right in with what has probably crossed everyone’s mind: How do you save up for big purchases?

Retirement savings and emergencies aside, how do we save for major expenses like our yearly vacations or that sweet house down payment?

My go-to strategy? Allocate a separate savings account for each expense (goal).

Then give each account a clear name tied to its purpose for extra motivation.

One of the best and easiest ways to dedicate a fund to multiple big purchases is through Ally Bank’s Savings Buckets feature.

Before this feature existed, I had to open individual savings accounts at Ally or my other banks which wasn’t difficult but a bit tedious.

However, with Savings Buckets, it has become as easy as going into my Ally app and instantly opening a bucket for each of my savings goals. You can open one from their preset categories or create your custom labels.

What more can you do? Once you have multiple buckets set up, you can also easily move money around. Just the other day, I moved money from my Self-Care bucket to Vacations because the self-care visits I had planned for ended up costing less.

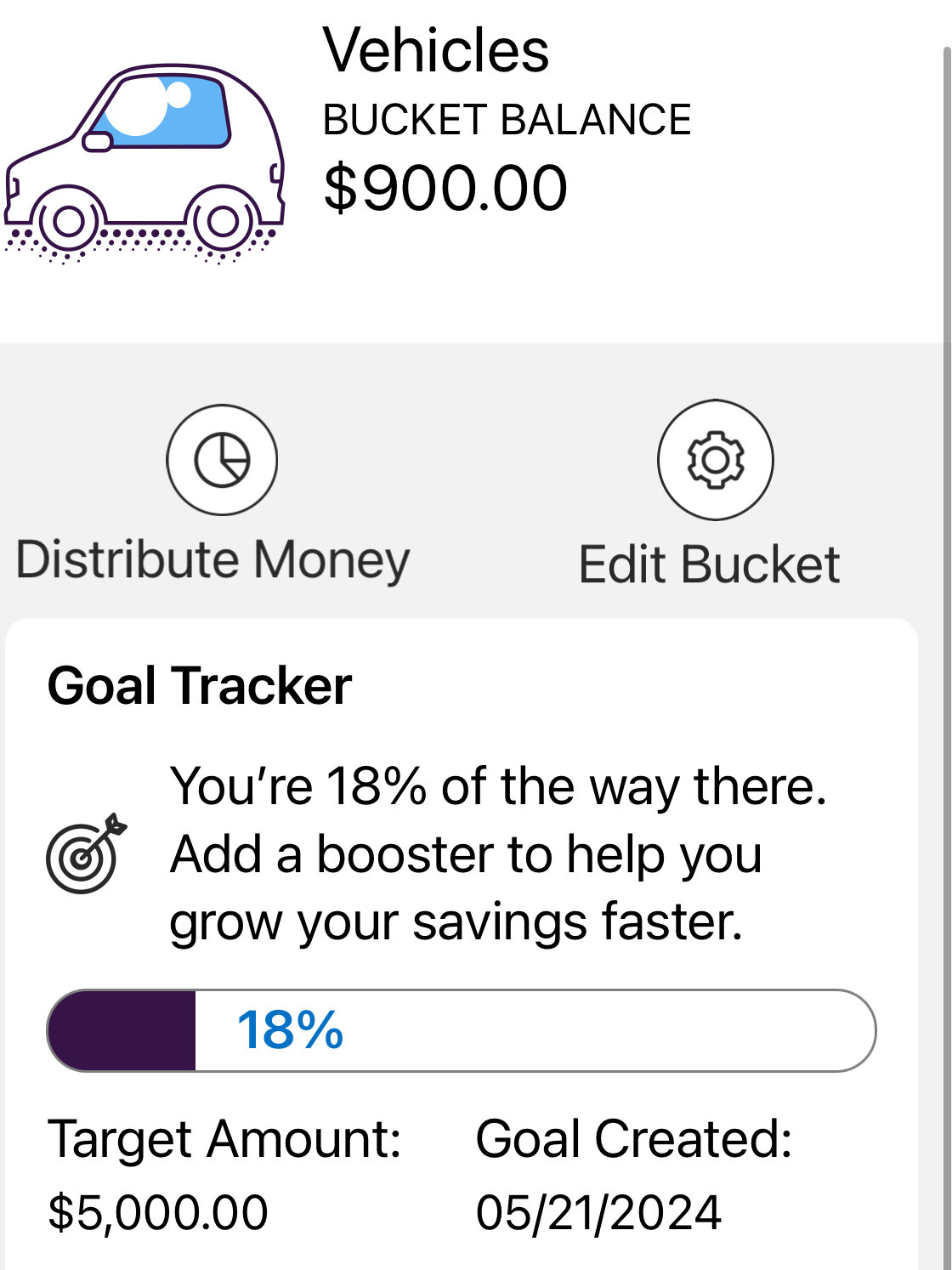

You can also set a savings goal and timeline for each of the accounts. I love this because thinking about how much you need by exactly when makes your financial plan more specific and tangible.

For example, if you are trying to buy a car next year, you will likely need to save for a down payment. Instead of blindly saving whatever amount feels ‘right,’ setting a realistic goal for your down payment and assigning a target timeline can boost your motivation.

And voila! Every time you open the app (or browser), you will see exactly how you are pacing towards your savings goal.

Now you may think- how is this different from having one savings account? Well, buckets are like digital envelopes that allow you to see exactly how much you’ve saved towards each specific goal. From my experience, this is way more motivating than seeing one big lump sum.

I can also spend money more guilt-free knowing that I’ve saved for each specific category. For example, I have a Purchases bucket where I put smaller amounts of money aside each month to fund a large purchase down the line- whether it be a piece of jewelry, a designer bag, or a table you’ve been eyeing.

There are also Bonus features to consider to supercharge your savings:

– Recurring transfers: With this, you can set up automatic deposits to your buckets so you “pay yourself first” without even thinking about it

– Surprise Savings: This tool analyzes your spending from the linked checking account and finds ways to save more. It then automatically transfers that extra cash into your buckets

– Boosters: This rounds up your spending to the nearest dollar and that difference in your spending account gets stashed away in your savings

So, there you have it — a savvy saving strategy to make those big-ticket dreams a reality or those looming expenses less daunting. With a little planning and technology, you’ll be crossing those financial finish lines in no time.