Are there any savings hacks other than “make coffee at home”?

Are there effective ways to set yourself up for success in the new year so you don’t have to pinch pennies to save more money?

Here’s the thing. I cannot tell you what expenses to cut out. Only you can do that.

Nobody needs someone to tell them to stop buying something they love. I know an $8 Matcha latte appalls some people; but to me, it’s a treat.

So I’m not going to tell you what to save on; I’ll tell you how to save better.

Here, I share 7 habits to help you actually save that aren’t just cutting out overpriced lattes (come on, nothing tastes better than an overpriced latte someone makes for you).

1. Track Your Expenses

You ever look at your credit card bills and think, “How the **** did I spend this amount of money?!”

And you may have even thought that your card got hacked.

Nope, it was all you.

I think we overlook how sneakily money leaves our accounts- the $13 subscription here, the $7 egg sandwich there, the $45 pants on sale here, and the $90 gym subscription there…

And this is exactly why you need to TRACK YOUR EXPENSES for at least a few months. Track even the smallest expenses because they add up. That’s how your credit card got to where it is.

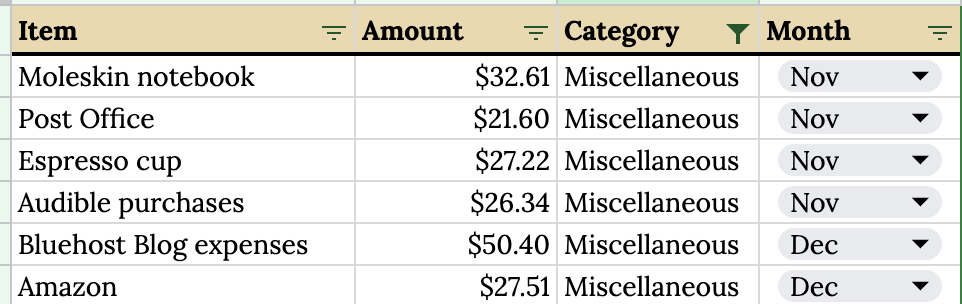

To illustrate my point, here’s a snapshot of how much I’ve spent in the “Miscellaneous” category in the last two months of 2023.

These expenses were so insignificant that I categorized them as “Miscellaneous” but they total $185!

OK, yeah maybe you can afford $185 in your budget, but do this with a few more categories, and you will see your spending skyrocket.

I get it- tracking expenses is not fun. But it’s way easier with apps like Mint!

Once you do this, you will see your spending patterns. You will see where you’re spending a lot and where you could potentially cut down.

Only you know what matters to you, so keep what you like and ruthlessly cut down on what’s not important to you.

When you can name where your money’s going, you can redirect it. You can find expenses that aren’t serving you and put it back into your savings.

2. Create Small Savings Goals

When we make our initial goals too lofty or vague like “Retire early” or “Buy a house,” we are bound to fail.

Now I’m not saying to not have these goals– they are excellent long-term goals. But they need to be supplemented with smaller milestones.

Try creating small, specific goals to keep yourself motivated and on track.

If your goal is to save $5k, break that into smaller chunks. Saving $5k in 10 months translates to $500 a month, and if that sounds like a lot, try $125 a week. By following step 1 (tracking expenses), you will hopefully find some areas in your spending you can cut down to save this amount.

When you are new to personal finance, it’s important to set realistic milestones that you can tangibly envision.

One method I like to utilize is “converting” a non-essential weekly expense I have into a potential savings opportunity. For example, you can use public transportation instead of Uber. Albeit small, skipping two Uber rides can mean saving $50 each week which can balloon up to $1k over a few months.

In my personal experience, it was way harder to save my first $1k than the next few thousand dollars.

Once you get into the habit of creating small goals and saving little by little, you will find it gets incrementally easier to save. It can be discouraging at times, but trust me, you will see your account grow.

3. Utilize a High Yield Savings Account

If you don’t already have a high-yield savings account (HYSA), you need to open one up NOW.

These are savings accounts that offer interest rates far higher than the average APY (annual percentage yield) of 0.6%.

I have my savings account with Ally Bank which currently has a 4.25% APY. However, many others offer similar or even higher rates. The list of others is outlined in this article.

How a high-yield savings account works is no different from how a normal savings account works, except it gives you money. As I said, a typical savings account in the US gives less than 1% interest.

If your money is stored in one of these accounts, you probably didn’t even notice the interest earned on your money, as it’s typically negligible. But in one of the HYSA accounts, take Ally for example, you will see free money tacked on as interest.

For instance, an initial deposit of $1k into Ally and contributing $100 every month will make $65.70 in interest the first year. That interest would be $0.15 (15 cents) if you had a typical savings account with a 0.01% APY. If you up your monthly savings to $250 a month in a HYSA, you will see $100 in extra money!

4. Automate Your Savings

This is probably my #1 tip to make saving easier.

This has worked so well for me because if you are anything like me, it’s much easier to not spend the money that you don’t see.

For a while, I had only saved what was left after all my expenses were taken care of. But this setup made it almost impossible for me to prioritize my savings.

Automating savings is super easy to do online with almost any checking account.

Taking Ally again as an example, you can either go on their website or the mobile app and set up a recurring transfer. You can set the money withdrawal date as your payday.

So if you get paid every other Friday, your checking account will automatically transfer money to your savings every other week on your payday. This also helps create a flawless strategy for where your money should go.

You can also automate savings by splitting your work direct deposit into two accounts. For example, you can route 90% of your pay into your checking and the remaining 10% into your savings account.

But keep in mind before you automate your savings that you have sufficient funds to cover your bills and debt. You do not want to get into debt because you are prioritizing your savings and do not have enough money left over for your groceries.

5. Unsubscribe

I love targeted ads. Most of the brands that I currently love or am interested in were probably surfaced to me by Instagram at some point. You harmlessly scroll and click on a brand. Maybe save a few posts, check their website, and even sign up for their promotion emails.

Sound familiar?

I work in the Advertising industry now and I see that it’s a $600 billion+ industry designed to make people feel like they are lacking something. Advertising is meant to get people to spend. And if we think we are above it, we are wrong.

What’s the best way to fight this?

Unsubscribe. Don’t let those promotion emails come through. Every few months, I go through an Unsubscribe spree where I hit this button on every promotion email in my inbox. If I don’t see it, I likely won’t buy it.

Also, go on social media fast. I have taken a 9-month Instagram hiatus and it was one of the best decisions I’ve made. The toll it takes on our mental health and our wallet is real. So the best thing is to avoid it altogether sometimes.

6. Plan and Prep Ahead

From what I’ve seen from myself and others, impulsive buying and keeping up with the Joneses make it really hard to save.

Related to my point above, advertising is so powerful, and with technology, it is all around us. In combination with unsubscribing, planning is super effective at helping us control our spending.

Both methods encourage intentionality– instead of buying cute shoes on a whim or trying that new hair product every Influencer seems to have, we turn towards ourselves and focus on what we need.

Any time I think of something I want to buy, I write it down. I have an ongoing list of products, clothes, and gadgets that I want. The list helps me confirm if I actually like the item or if the model is just beautiful. It also helps me assess whether the item reflects me.

For example, when shopping for clothes, I think about:

– How each item would fit with my style

– How many different outfits I could create with it

– If there are similar alternatives I already have in my wardrobe

This helps slow things down.

Over time, I either become uninterested in most of my list or I know what I really want.

The same goes for groceries. Doing a quick inventory check of what ingredients you currently have, planning out your meals for the week, and creating a grocery list will go a long way.

7. Save Extra Income

Alright lastly, save any extra money that comes your way.

This can be your tax refund, your work bonus, cash on some old items you sold, a monetary gift… the list goes on. Whether it’s an extra $20 or $5k, put it in your savings!

Saving is a patience and strategy game, so when there are surprise or unexpected boosts, leverage them. No matter how small, giving your account a little push is a step (or two) closer to your savings goal.

You might get tempted to spend the bonus or that refund on treating yourself. That’s normal!

If you have the discipline to save the entirety of your extra income, all power to you. If not, I would say choose one thing you can comfortably afford with the extra income for yourself and put aside the rest. The more practice you get with prioritizing your savings, the easier it will become.

Watch Your Savings Grow

Now with the 7 steps listed above, all you have left to do in 2024 is sit back and watch your savings grow.

Ok, maybe it’s not exactly “sitting back” because saving money takes a lot of work and patience, but these steps will help you put an effective system in place. They will guide you when times are tough and hopefully make saving money a bit easier than before.

Pat yourself on the back for taking the first step to committing to save money. You will see your cash cushion grow so much more this year. Good luck!

Comments

4 responses to “7 Simple Ways to Boost Your Savings in 2024”

So helpful! So glad I stumbled on this blog

Thank you Jimmy! I’m glad you are here 🙂

I also found it really helpful! I already can’t wait for your next post 🙂

Thank you Ashley! Can’t wait to have you visit again