Raise your hand if you looked at your credit card balance and thought you got hacked.

“I spent $5000 last month?! This must be a fraud.“

It’s unbelievable how fast our transactions add up but how slow it is to save $5000 in a year.

Why is that?

If you’re feeling discouraged about your savings, you’re not alone. More than a third of U.S. adults have more credit card debt than emergency savings (source: Bankrate).

And I was in the same boat. I depleted my savings to move to Boston after graduation and had to re-build my savings from practically $0.

Fearing that I’d have to move back home if my financial cushion wasn’t big enough, I created a savings plan and followed it consistently.

I found that just like how seemingly random expenses add up to thousands in credit card debt, seemingly small steps could also add to thousands (and beyond) in savings!

There were 4 simple steps I took to build my savings.

And in this post, I will share the steps on how to save $5000 in a year.

Step 1: Create a savings plan

Set a goal and make a plan.

If you’ve tried to achieve anything in life, you know an arbitrary goal without a plan is just a daydream.

To save $5000 in a year, you may simply divide the number into 12 months for a monthly goal.

But you can also create a different plan based on your savings styles and preferences. Let’s explore what this means:

Example 1- simple approach

If you like simplicity and minimal thinking, this one’s for you.

This plan has regular amounts (until month 11), which makes it super easy to set up automatic transfers. They are also easy, even numbers, so it’s easy to keep track.

If you want to save more frequently, you can also break it down into weekly goals ($100 x 52 weeks = $5200).

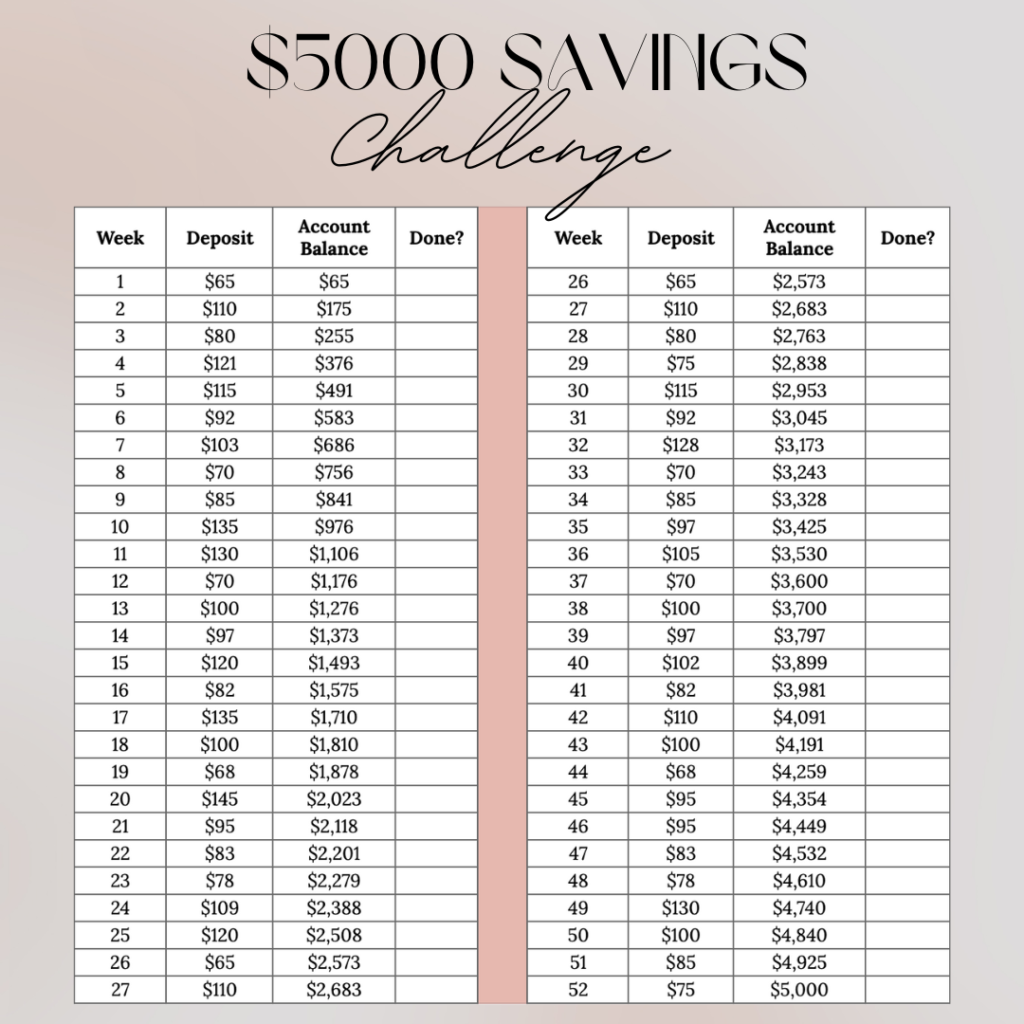

Example 2- savings challenge

The second approach utilizes a savings challenge and is quite the opposite of the first.

The numbers look wild, but this approach works very well for some:

I would recommend this to those who have struggled to save money in the past.

Here are the reasons that make this approach worth trying:

This atypical approach can feel novel and psychologically more motivating. It’s broken into weekly goals, so the numbers are smaller and feel more doable. It’s great for boosting our confidence.

Secondly, a shorter time frame with a very specific number makes the plan more actionable. The strange, odd numbers might also remind us of random expenses that we see on our credit cards.

It encourages us to brainstorm where we can find this extra $82. You might start looking for the random apps and streaming sites you’ve been subscribed to.

Instead of forgetting about our savings goal and then being disappointed at the end of the month that we overspent, we are held more accountable and become disciplined.

Lastly, the savings challenge visual can add some fun and motivation (you can save on Pinterest!). If you print it, you can make it into your habit tracker.

James Clear, the author of Atomic Habits, explained so clearly why tracking habits can be helpful. It makes us more aware of what we do and not just what we think we are doing. Seeing our progress visually is also motivating and allows us to celebrate big and small milestones. It’s like creating a positive reinforcement and rewards system for yourself.

Here’s how I would leverage this approach: I would round up each week’s goal. If the goal is $65, well let’s transfer $70.

This can boost your savings and help you save $5000 in a year or less.

Step 2: Track your expenses

So you’ve got the plan. Let’s find out where the extra money will come from.

If you’ve ever tried to lose weight, you probably had to assess where you can cut down on calories.

Maybe it’s the habit of drinking a few beers every night. Maybe it’s the bagel with cream cheese and a sweet latte for breakfast. Whatever it may be, certain choices have led you to consume more than your body requires.

It’s the same thing with cutting expenses. Whatever it may be, something is not adding up. If there is $0 in savings, that means you are using up all of the money you are making.

And we need to find where we can create a gap between what you bring in and what you spend.

If you are new to saving and personal finance in general, I highly recommend you track your expenses in the first couple of months.

That way, you can see exactly where you are spending where or when you don’t need to.

Or you might find that no matter how frugally you live, you cannot keep up with your expenses. That should be a clear sign you need higher or additional income.

How to track

When I first started working and was budgeting for the first time, I tracked my expenses manually. I preferred that method when I was starting because inputting each item allowed me to understand my spending habits and values. It also worked because I only had one checking account and one credit card.

Now, I have way too many accounts to track, so I prefer using an app like Mint (which is now CreditKarma!). Once you connect all your accounts, the app automatically consolidates your transactions.

It’s not perfect, but you will appreciate that it gives you a quick snapshot of your finances without toggling between multiple apps.

Step 3: Reduce spending (Hint: Keep fixed expenses low)

Once you’ve assessed your spending pattern, it’s time for you to choose which expenses to cut out. And cut it out.

To save $5000 in a year, you need to save $400~500 a month for 12 months. But there isn’t just one way to do this.

If you can reduce your fixed expenses like rent and car costs, you can save much faster.

And I get it, rent is sooo expensive. Especially in cities like New York, San Francisco, LA, etc.

But living with roommates or moving to a cheaper place will undoubtedly help save you $5000 in a year more effectively than not getting guac in your Chipotle bowl.

If you are serious about saving, tackling the big categories like housing and cars will go a long way. And that’s what helped me save at 23.

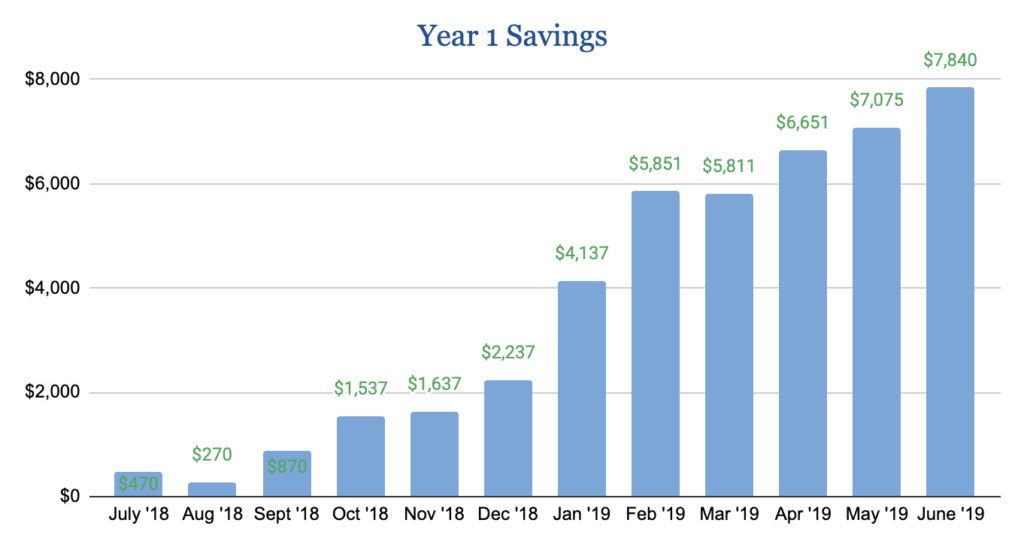

A snapshot of how much I saved in my emergency fund in my first year of moving out:

This was only possible because my room was a “flex” room in the living room and I had two other roommates. I sacrificed my living space for cheaper rent and a 15-minute commute to my office.

The next year, I still had two other roommates but got my own room (thank goodness) in a brand new apartment but lived further from downtown.

My point is- something’s gotta give.

But if reducing fixed expenses isn’t feasible for you, look for other categories.

And I’m not talking about skipping the oat milk for your latte. I’m referring to bigger ticket items or repeated expenses that will make a bigger dent.

It will be different for each person, but some examples might be:

Big spending categories

– Travel

– Shopping

– Going out (if frequent)

– Eating out (if frequent)

Repeated expenses

– Gym or fitness memberships

– Streaming subscriptions

– Any other subscriptions (i.e. clothes rental, apps, Audible, etc.)

– Personal care services (i.e. lash extensions, massages, hair care, etc.)

Again, only you can decide which expenses you can cut out vs keep.

If you can save $5000 in a year by not purchasing a couple of bags and shoes, there you go. Redirect that money to savings and you will hit $5k.

What worked for me was a combination of keeping my fixed expenses low and reducing repeated expenses like personal care treatments.

I saved a few hundred dollars extra from stopping my lash perms and facials. The biggest motivation for stopping them was not my finances- I was just tired of the upkeep, but my bank account was thankful too.

I still love a good facial and a spa, but most of the time, what we think is a “need” is just a “want.” And simplifying our routines can inadvertently help with our finances.

Step 4: Build a system that works for you

If you’ve found a way to save $500 once, great job!

Now how do we do this every month?

First, you will need a savings account to direct your money.

Then you need to build a good system.

Because personal finance is a lot like personal fitness, it’s critical to build a system that enables good habits.

This usually means we need a routine that requires the least amount of thinking and puts us on auto-pilot. That’s the best system.

Yes, everyone’s system will vary by their tendencies, values, and styles. But I find that for most people, automating your savings works extremely well in this regard.

You can set up weekly or biweekly transfers from your checking account to a savings account at a different bank, so it’s harder to reach.

When the money is not in your immediate access, you will learn to spend with what you have.

If you are trying a more hands-on savings plan like the savings challenge I shared earlier, be detailed about your system.

Are you going to have a printout on your fridge or keep a tracker in your notebook? Will you do an online transfer every week? How will you find the money you need to save every week?

Start with these questions and plan, so that you have a good foundation to begin saving.

Last thoughts

Saving money is hard.

The concept is easy. We need to spend less than what we make and save (and invest) the excess.

But it’s just like our fitness journey.

We all know that weight gain or loss is the difference between how much we consume vs burn.

And yet here we are googling “How to look like J. Lo in 2 days.“

We all know how to be fit- drink lots of water, eat healthy, exercise regularly, blah blah blah- but we are still looking for the miracle detox drink that’s going to free us from daily discipline. It’s hard to do the work.

But don’t be so hard on yourself.

Whether it’s physical wellness or financial wellness, most of the work is in the routine you build. And if you haven’t gotten into the habit of saving, it just means you have not yet found a system that works for you.

I hope this post gives you some helpful suggestions on how to start building your savings muscle.

It’ll take some trial and error. And the results won’t be overnight.

Like with anything worth having in life, it won’t come easy. But it will get easier once you finally find a system that works for you!